Most counties in Florida access at roughly 90% of the current value of the property. If the value of a prospective home is $500,000, your county should assess at approximately $450,000 =/-.

If this home will be your primary residence, you can apply for a $50,000 homestead exemption ($25,000 per individual). This as part of the Save Our Home Act will also limit your property tax appreciation to 3% max per year.

Example:

$500,000 Value

$450,000 Assessed Value

-$50,000 Homestead Exemption

____________________________

$400,000 Taxable Value x 1.03% (Oxford) = $4,120 Estimated Property Taxes

**If you are moving to Florida from an area with a higher tax burden, please do not dismiss the differences in property taxes. This will have an effect on the future value of your home.

Using the same taxable value as the example above the highest tax rates = $6,520 ($2,400 Difference)

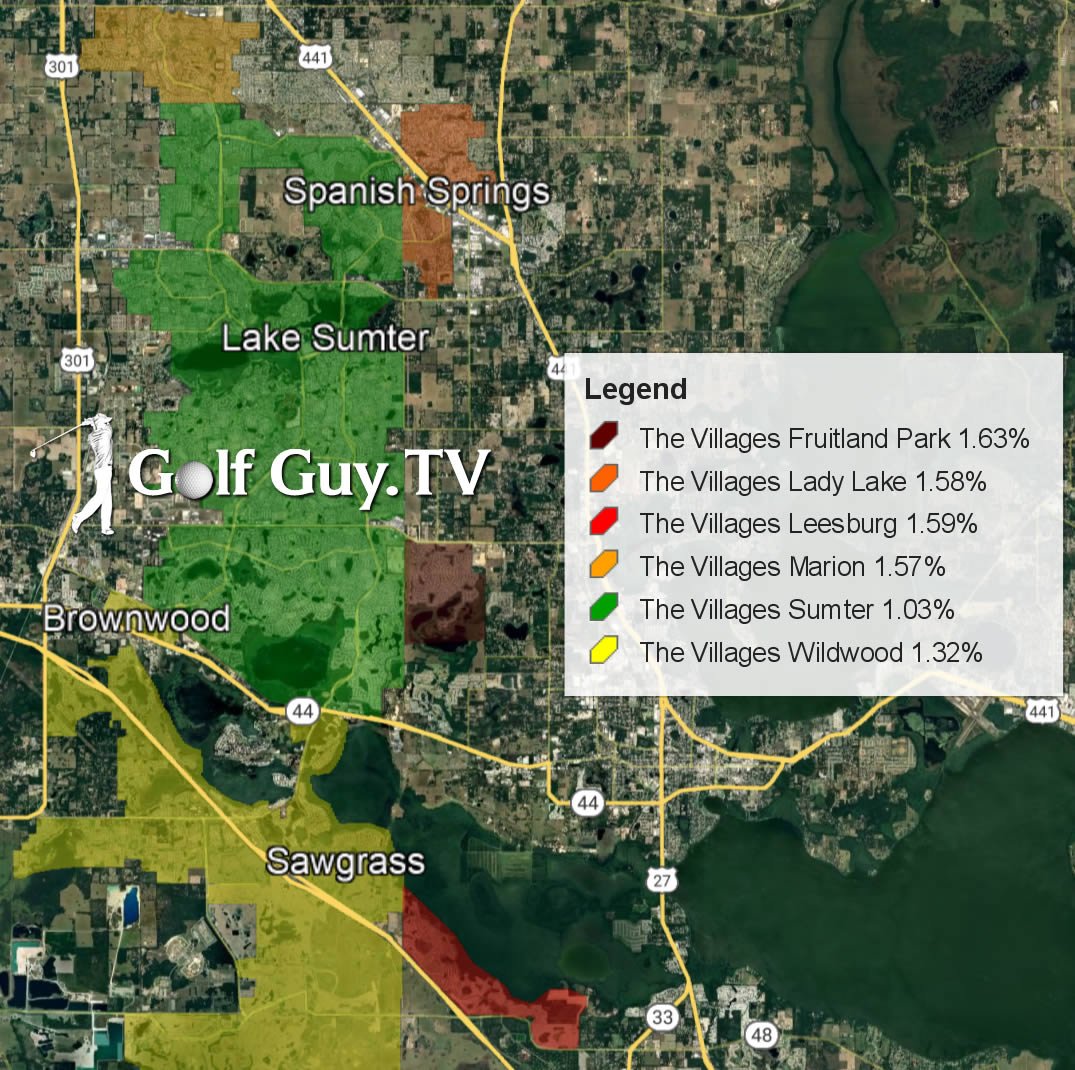

The Villages Property Tax Map

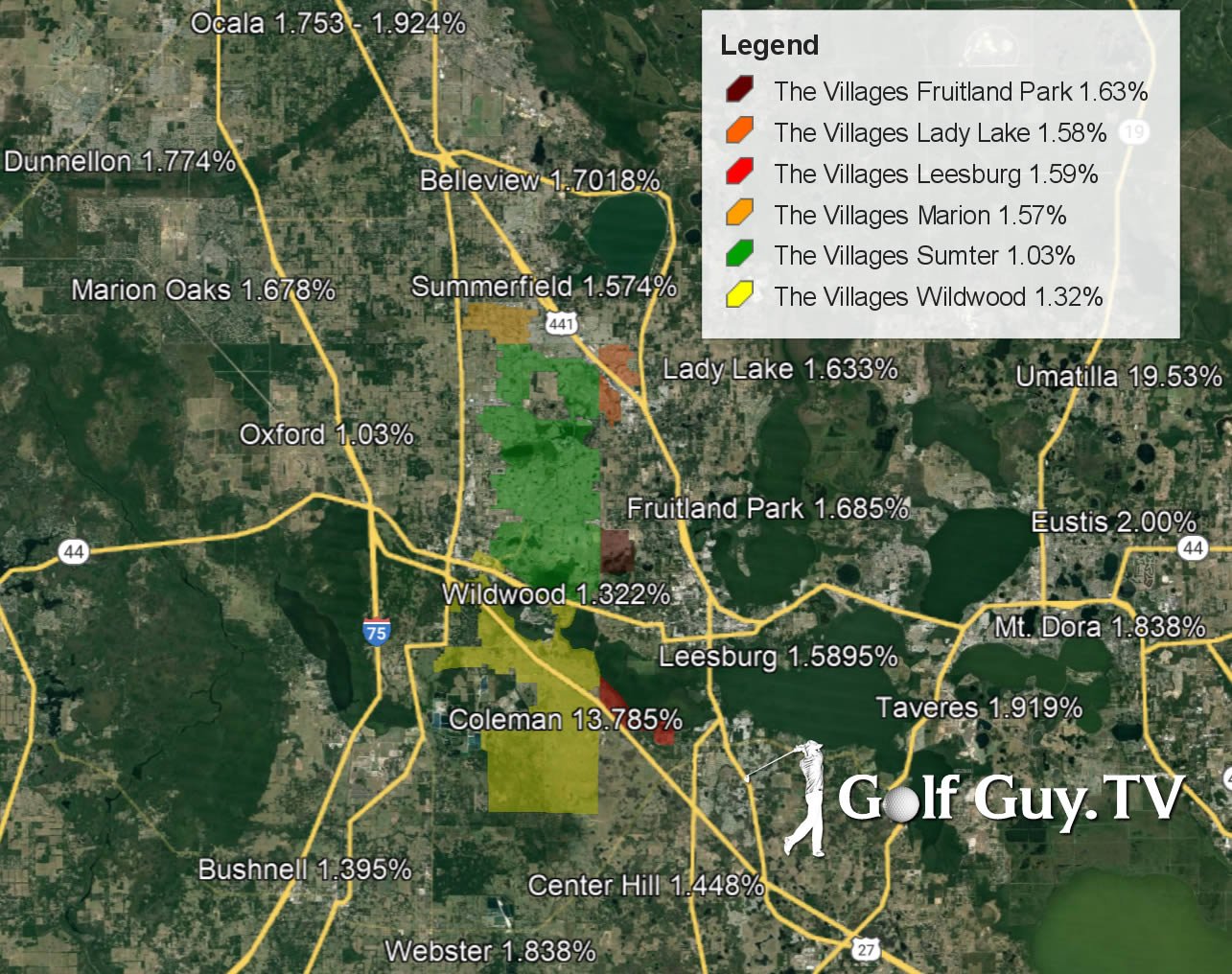

Sumter, Lake & Marion County Property Tax Map

**Property tax maps are intended for informational purposes only. Our goal is to help provide a more straightforward estimate of what your property taxes would be instead of relying solely on what the previous owners paid. Please verify with your prospective county before purchasing.